Safeguard Yourself Against Fraud

Fraud is on the rise and wreaking havoc on the lives of many Americans. While everyone is at risk and there’s no foolproof way to eliminate it, learning how to safeguard yourself against fraud can go a long way in lowering your risk. According to the Identity Theft...

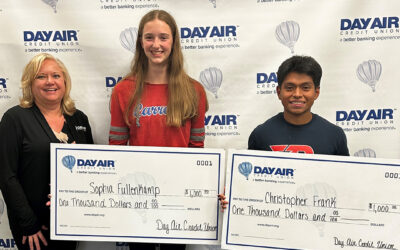

Day Air Credit Union Awards Two $1,000 Scholarships to Area Students

Day Air Credit Union was proud to partner with the Dayton Dragons to present College Prep Night to local high school students and their families. College Prep Night took place at Day Air Ballpark and the free event provided more than 2,000 high school students the...

Day Air Credit Union Welcomes Pat Koons as Financial Advisor to Expand Member Financial Services

Day Air Credit Union is excited to announce the newest addition to their team, Pat Koons, who will be joining as a Financial Advisor. With an exceptional track record and a passion for helping members achieve their financial goals, Koons brings a wealth of experience...

Fall Travel on a Budget

There's been a resurgence in travel for business and personal leisure in 2023 as more Americans return to their 'new normal' following a global pandemic. Booking.com polled Americans on preferred vacations and 88 percent would favor a nostalgic getaway, while 80...

Consumers with Higher Credit Scores Benefit Financially

Closely managing your credit score is important, especially since consumers are reporting access to credit is harder to achieve right now. Your credit score is one of the key factors that lenders, like credit unions, use to approve a mortgage, auto loan, and credit...

Tips to Help Pay Down Student Loans

College graduation can bring both excitement and anxiety for students gearing up for the next stage of life. While employment prospects for 2023 grads are mostly positive, many are starting their professional careers with a lot of debt, which can be overwhelming. The...

Creative Ideas for Budget-Conscious Travelers

After a long hiatus from traveling during the pandemic, many Americans are once again pulling their suitcases out of storage. While the impulse to go crazy with plans may be strong, you probably don't want a vacation-debt hangover that lasts for months after your...

Tips to Help you Decide When to Pay with Cash, Debit, or Credit

There are many advantages and disadvantages to using cash, debit, or credit for your spending needs. When should I use cash? Cash is still the best option for small transactions. It is also helpful when shopping at places that don't accept debit or credit cards....

Day Air Credit Union Awards One $1,000 Scholarships to Area Students

Day Air Credit Union is pleased to announce that Nathan Snizik is the recipient of Day Air’s 2023 Academic Scholarship. The Day Air Academic Scholarship is awarded annually to a local students who demonstrates academic achievement and community involvement. Nathan...

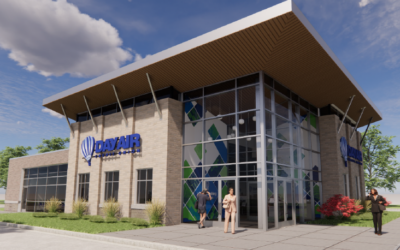

Day Air Announces Plans for a New Butler Township Branch

Kettering, OH - Day Air Credit Union is excited to announce the future construction of a new state-of-the-art branch in Butler Township. The new stand-alone branch will be built on a plot of land at 7919 N. Dixie Rd. When completed, the new location will house the Day...

Tips to Teach Children How to Save and Spend

It is essential to start teaching your child about good spending habits from an early age. Then, as they get older, they will utilize those tips and be able to make smart financial choices for their own families. It can be difficult for a child to understand the...

Prequalify to Move into New House

As you look into buying a house, you may hear the terms preapproval and and prequalification. Here's a brief explanation of those terms: Prequalification is a rough calculation of the mortgage payment you can afford. Our mortgage loan originators can help you with...