Make Your Dollar Go Further!

At Day Air, a better banking experience means a little extra on everyday purchases. A Day Air Cashback Checking account comes with a debit card that earns 2% cash back on purchases up to $750.*

What will you do with your cash back?

15 swipes for $15 each month

Use your Day Air debit card at least 15 times each month and get an extra $15* in your account. That’s a better banking experience.

Ditch hidden fees for using your Day Air debit card

Day Air debit cards work everywhere VISA® debit cards are accepted. And unlike some prepaid cards and traditional bank accounts, there are no monthly account fees.

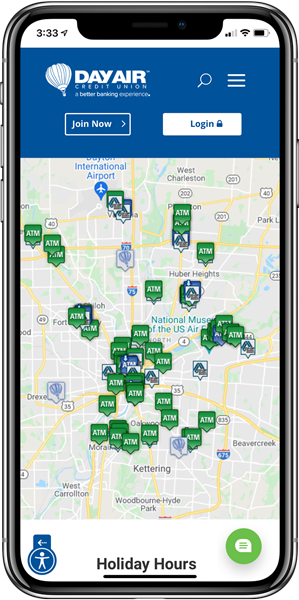

Access to 30,000+ surcharge free ATMs and 5,900 branches nationwide

With Day Air, you get access to 30,000+ surcharge free ATMs and over 5,900 branches nationwide through our shared branching network. Need to find an ATM or branch near you? Simply use the map in the Day Air app to find the nearest one.

The Debit Card for your connected life.

- Day Air Pay Someone allows secure payments to friends and family.

- Control transactions, including disabling activity with Day Air Card Controls.

- Set up alerts and be in the know.

Open your Day Air CashBack checking account now.

Take 5 minutes to start earning 2% cash back.

Already a Day Air member?

If you currently utilize Day Air Online Banking, you can open these accounts immediately through that channel. Just log in, go to “New Accounts” and choose the type of account you would like to open.

Day Air Online Banking First Time Users

Click Here to get started and then follow the on screen prompts.

Questions? Get in touch with Day Air Credit Union.

- Chat with a Day Air Member Service Representative

- Click on the green chat icon

in the bottom right corner of this web page and a member service representative will be happy to assist you.

in the bottom right corner of this web page and a member service representative will be happy to assist you.

- Click on the green chat icon

- Text with a Day Air Member Service Representative

- Send a text message to 937-643-2160 and a member service representative will be happy to assist you.

- Call the Day Air Member Service Center

- Call Day Air at 937-643-2160 or toll-free at 888-329-2472 and a member service representative will be happy to assist you.

*Complete Qualification Information: Account transactions and activities may take one or more days to post and settle to the account and all must do so during the Monthly Qualification Cycle in order to qualify for the account’s rewards. The following activities do not count toward earning account rewards: ATM-processed transactions, transfers between accounts, debit card purchases processed by merchants and received by our bank as ATM transactions, non-retail payment transactions, and purchases made with debit cards not issued by our bank. Transactions bundled together by merchants and received by our institution as a single transaction count as a single transaction for the purpose of earning account rewards. “Monthly Qualification Cycle” means a period beginning on the first business day of the month through the last day of the month. Reward Information: When CashBack qualifications are met during a Monthly Qualification Cycle, you will receive (1) 2.00% cash back on up to a total of $750 PIN-based/signature-based debit card purchases that post and settle to the account during that cycle period. A maximum of $15.00 cash back may be earned per Monthly Qualification Cycle. You will also receive reimbursements up to an aggregate total of $10 for nationwide ATM withdrawal fees imposed by other financial institutions and incurred during the Monthly Qualification Cycle in which you qualified. We reimburse ATM withdrawal fees based on estimates when the withdrawal information we receive does not identify the ATM fee. If you have not received an appropriate reimbursement, we will adjust the reimbursement amount if we receive the transaction receipt within 60 calendar days of the withdrawal transaction. When CashBack qualifications are not met, no cash back payments are made and ATM fees are not refunded. Cash back payments and ATM fee reimbursements will be credited to your CashBack account on the last day of current statement cycle. Rates and rewards are variable and may change after account is opened. Additional Information: Account approval, conditions, qualifications, limits, timeframes, enrollments, log-ons and other requirements apply. Monthly enrollment in online banking, receipt of electronic statements, and at least 15 debit card purchases post and settle are conditions of these accounts. Enrollment in electronic services (e.g. online banking, electronic statements, and log-ons may be required to meet some of the account’s qualifications. Limit 1 account per social security number as primary owner. There are no recurring monthly service charges or fees to open or close this account. Contact one of our member service representatives for additional information, details, restrictions, processing limitations and enrollment instructions.