2022 Annual Report

Bank Better. Live Better.

LETTER FROM THE CEO AND BOARD CHAIRMAN

To our members,

Once again, for many years now, this past year can be considered Day Air Credit Union’s best year ever. Your credit union achieved numerous successes throughout 2022 and stayed true to its core mission of enhancing members’ financial well-being. We are continuously growing yet remain humble to ensure that all members enjoy the better banking experience they’ve come to expect at Day Air.

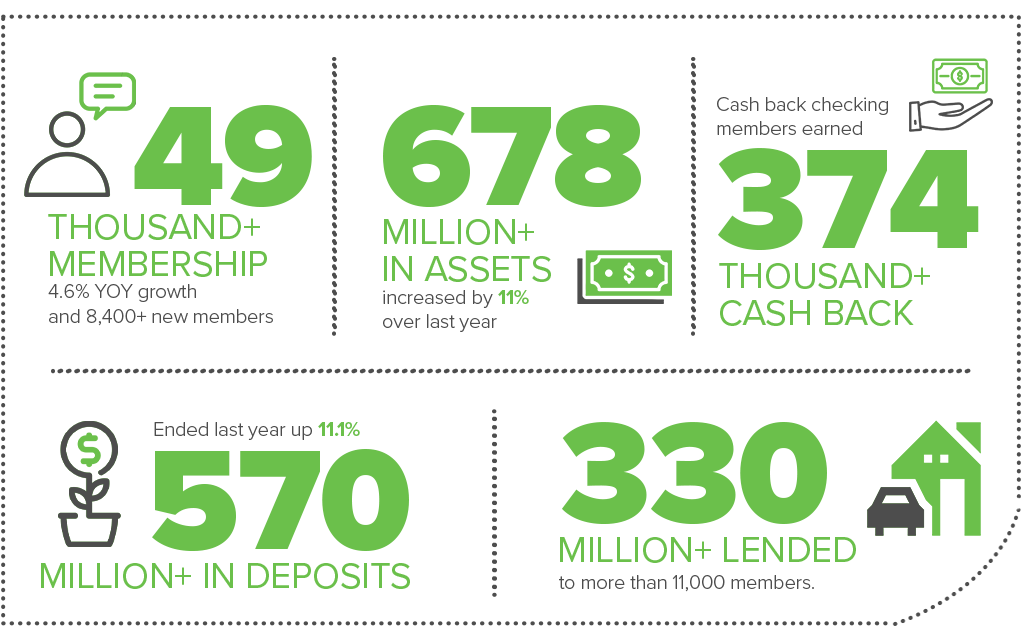

In 2022, Day Air soared to new heights with record-setting growth, ending the year with the highest numbers ever recorded in almost all key metrics. We lent over $332 million in consumer, commercial, and real estate loans. Total deposits increased by more than 11% to over $570 million. Finally, Day Air remained the largest financial institution headquartered in Montgomery County, with more than $678 million in total assets.

Day Air doesn’t just strive for outstanding financial performance. We also take great pride in providing our members with an exceptional banking experience – and 2022 was no exception! From introducing new products to implementing innovative processes, Day Air made plenty of progress in 2022:

- Day Air’s One Click Loan offers were enhanced to provide an even more frictionless borrowing experience for members, helping them get needed funds quickly and safely.

- Day Air Members utilizing Day Air’s Cash Back Checking Account earned over $374,000 in 2022.

- Day Air enhanced its online business banking platform, BizLink 247, for an even better business banking experience. Business members can now view account information quicker, enjoy new banking widgets, and can access card controls for their business debit and credit cards.

- Day Air gave members quicker access to their credit score information by making them available within the Day Air App.

- Enhancements were made to Day Air Online Banking and the Day Air App to continue providing members with the best possible digital banking experience. Just a few of the many enhancements in 2022 included an updated card controls widget, quicker account summaries, credit scores, and new quick transfer options.

- For the first time ever, members could vote for the Board of Directors via the Day Air App. It’s likely no coincidence that more votes than ever were cast in the 2022 Board of Directors Election.

- Day Air enhanced its appointment scheduling software to make it easier for members to book appointments online, over the phone, and via the Day Air App.

- Day Air maintained its designation as a Community Development Financial Institution, CDFI, a testament to our commitment to providing financial services in low-income communities and to people who lack access to financing.

- Day Air was listed as a Dayton Business Journal ‘Best Place to Work,’ ‘Top 100 Company’, and ‘Fast 50 Company’.

- Day Air Ballpark ranked 1st in attendance among all minor league venues in the country, averaging over 7,900 fans per game.

Day Air will continue to roll out new products and services to meet Membership needs. Whether it be advancements in technology for even more streamlined experiences or enhancing opportunities to provide you with the personal banking touch, you’ve come to expect when banking with Day Air. As we continue to focus on the success of Day Air and its members, we will remain rooted in our commitment to quality financial products and services.

We look forward to growing the possibilities of members who trust us with their banking needs, along with the communities we all call home. It is an honor to serve Day Air members and assist them in making important financial decisions that will impact their lives now and in the future.

– William Burke, President and CEO

– Tim Brown, Board Chairman

Annual Member Savings

$7,578,715

Annual member benefits equivalent to $2,035 per high-use household $334 per household $159 per member

Day Air is committed to returning profits back to members via better loan rates, higher savings yields and minimal fees. In 2022, this resulted in $7,578,715 in direct financial benefit* to members compared to area banking institutions during the twelve months ending September 2022. That’s an average benefit of more than $334 per member household*, and our most high-use households saw even greater benefit at more than $2,000*!

COUNT ON US.

Day Air saw tremendous success in 2022 due to the hard work of our associates and the flow of referrals we received from our valued members. We’re proud that more people are trusting Day Air with their deposits and loans, so if you want your loved ones to take advantage too, don’t forget to recommend us!

Day Air continues to grow, serving more and more of your friends and family throughout the Miami Valley. Whether visiting one of Day Air’s conveniently located branches or utilizing its innovative digital services, Day Air’s numbers and growth speak for themself.

Our members signal their customer loyalty and experiences via Net Promoter Scores (NPS). To gather NPS, we asked members: “How likely is it that you would recommend our company/product/service to a friend or colleague?” A score of 50% or more is considered excellent. In 2022, we earned an average NPS of 82.27%, well-above average in the financial industry.

Click on the images below to learn about just a few of the other milestones and awards Day Air earned in 2022 below.

82.27% NPS Score

Day Air’s Net Promoter Score (NPS), reached a record high of 82.27%, far surpassing the competition and serving as a testament to Day Air’s commitment to providing members with a better banking experience.

$140 Million

Day Air grew its First Mortgage Portfolio to over $140 million.

One-Click Offers

1,567 Day Air One-Click Offers were accepted by members.

Best Place to Work

Day Air was listed as a Best Place to Work by the DBJ for the fourth year in a row.

$120 Cash Back

Day Air members with Day Air Cash Back Checking Accounts earned on average, $120 cash back for purchases in 2022. This unique checking account is just one of the many industry-best products and services Day Air offers.

Fast 50

Day Air was recognized by the DBJ as one of the 50 fastest-growing businesses in Dayton.

$262 Million

Day Air grew its auto loan portfolio to more than $262 million and is one of the top auto lending institutions in the region.

Top 100

Day Air was included on the DBJ’s list of the Dayton region’s Top 100 businesses by revenue.

$2,035 in financial benefit

In 2022, high-use Day Air member households received more than $2,035 in direct financial benefit* compared to area banks.

In 2022 we served more members than ever, providing better rates, fewer fees, and service you can only experience at a local financial institution. Our mission of enhancing members’ financial well-being guided us forward, while our strong financial position enabled us to help more members.

As a financial cooperative, we bring people together based on shared values and goals. We are proud to do so while aspiring to improve our members’ and communities’ financial well-being.

IN THE COMMUNITY.

Day Air is passionate about positively impacting the places we call home. We don’t just offer financial services, we’re committed to creating brighter futures through our contributions that focus on Financial Education, Community Involvement, and Economic Development, as well as Scholarships for those looking to further their studies.

2022 was a busy year for us – with associates dedicating thousands of invaluable hours to give back to our communities. We look forward to continuing the significant progress made this past year and doing what it takes to create an even more substantial impact throughout the Miami Valley.

Click on the images below to learn more about some of the ways Day Air gave back to the Miami Valley in 2022.

$80,000

Through sponsorships and donations, Day Air gave more than $80,000 to community organizations in the Miami Valley.

89 Financial Education Classes

In 2022, Day Air taught 89 Free Financial Education Classes and Seminars for individuals, organizations, students, and other members of our community.

5 Scholarships

Day Air awarded 5 scholarships for higher education to members and area students.

$17,000

Day Air partnered with the Dayton Dragons to raise more than $17,000 in support of the Dayton VA Fisher Houses.

3,500 Community Members

Over 3,500 members of the Dayton Community attended classes and seminars hosted by Day Air in 2022.

$7,000

Day Air donated more than $7,000 to programs that directly support financial empowerment for underserved youth in our communities.

$10,000

Day Air provided financial education programs, and support and donated more than $10,000 to victims of domestic violence.

60 Organizations

Day Air supported more than 60 organizations in the Miami Valley in 2022. From financial education and empowerment to economic development Day Air is committed to serving the communities our members live in.

DAY AIR BALLPARK.

We’re proud of Day Air Ballpark and our partnership with the Dayton Dragons. Both organizations are committed to growing economic prosperity throughout the region. In 2022, Day Air Ballpark continued to serve as a key driver of economic growth, charitable events, and family fun for the region.

Click on the items below to learn more about the impact and milestones achieved by Day Air and the Dayton Dragons in 2022.

1st

500,000

College Prep Night

$27,500,000

Gem City Jerseys

$35,000

Early Access

2022 Day Air Financial Report.

as of 12/31/22.

In 2022, Day Air achieved record-setting growth and ended the year with the highest numbers recorded in almost all important key metrics. Day Air remains among the best-performing credit unions in the country in almost all financial categories, and you can rest assured that your money is safe, secure, and growing with Day Air.

ASSET GROWTH

REVENUE GROWTH

INCOME GROWTH

DAY AIR BOARD OF DIRECTORS.

The Day Air Board of Directors comprises members from our community who volunteer their time. You elect them as your representatives to guide the organization in its mission to establish governance policies and monitor Day Air Credit Union’s performance.

*Direct financial benefits to members during the 12 months ending September 2022 as defined in the CUNA Membership Benefits Report for Day Air Credit Union. ©CUNA, ©Datatrac

– NCUA Insured –

Deposits at Day Air Credit Union are insured to $250,000 by the National Credit Union Share Insurance Fund and backed by the full faith and credit of the United States Government. NMLS # 411837

Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and SEC Registered Investment Advisor. Products offered through CFS are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Day Air Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.